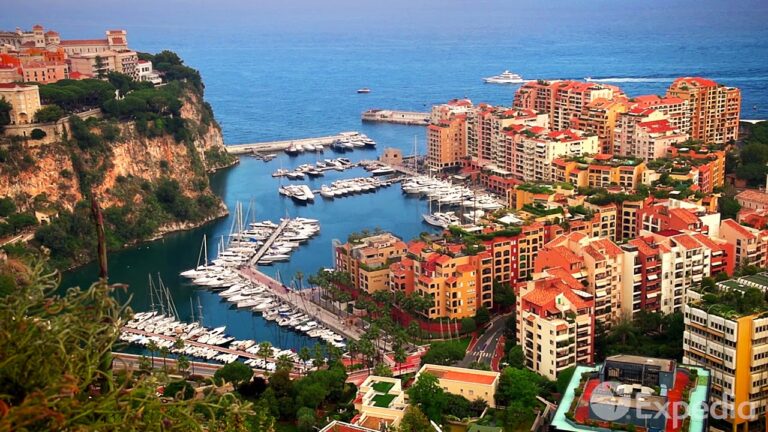

Comprehensive Trip Insurance: Protect Your Travel Investment Today

Going on a vacation or a business trip is an exhilarating experience that allows you to explore new places, cultures, and forge unforgettable memories. However, unforeseen circumstances can disrupt your plans and potentially incur significant financial losses. This is where comprehensive trip insurance comes to the rescue! In this article, we will delve into the importance of trip insurance and how it safeguards your travel investment.

What is Comprehensive Trip Insurance?

Comprehensive trip insurance is a type of travel insurance that offers an expansive range of coverage to protect you against various unforeseen events that may occur before or during your trip. Unlike basic travel insurance policies, comprehensive trip insurance provides additional coverages and higher limits to safeguard your travel investment in a more comprehensive manner.

Advantages of Comprehensive Trip Insurance

1. Trip Cancellation or Interruption Coverage: Comprehensive trip insurance provides reimbursement for non-refundable travel expenses if you need to cancel your trip due to covered reasons, such as unexpected illness, injury, or the death of a family member. It also covers trip interruptions caused by events like natural disasters, airline bankruptcies, or terrorist incidents.

2. Baggage and Personal Belongings Coverage: This type of insurance ensures that you are protected if your luggage or personal belongings are lost, stolen, or damaged during your trip. It covers the cost of replacing essential items, allowing you to continue your journey stress-free.

3. Emergency Medical and Dental Coverage: Comprehensive trip insurance provides coverage for medical emergencies that occur while you are traveling. It includes expenses such as hospitalization, ambulance services, doctor visits, and even emergency dental treatments. This coverage offers peace of mind, knowing that you are protected against unexpected medical costs.

4. Travel Delay and Missed Connections Coverage: If your trip gets delayed due to covered reasons, such as severe weather conditions or mechanical breakdowns, comprehensive trip insurance covers additional expenses like accommodation, meals, and transportation. Additionally, it also offers protection if you miss a connecting flight or cruise due to a covered event.

5. Rental Car Damage Coverage: Renting a car during your trip? Comprehensive trip insurance can provide coverage for damages to rental vehicles, saving you from potential hefty expenses.

How to Choose the Best Comprehensive Trip Insurance

Choosing the right comprehensive trip insurance plan is crucial to ensure you receive adequate coverage for your specific needs. Here are some key factors to consider:

Look for a policy with high coverage limits to adequately protect your travel investment. Make sure the limits align with the potential expenses you may face while traveling.

2. Pre-Existing Medical Conditions Coverage: If you have any pre-existing medical conditions, ensure that your policy covers them, as many insurance plans exclude pre-existing conditions.

3. Trip Duration: Consider the duration of your trip and select a policy that provides coverage for the entire period. Some policies have restrictions on trip length, so be mindful of these limitations

4. Deductible: Assess the deductible amount that you are comfortable with. A higher deductible may result in lower premium costs, but be sure you can afford to pay the deductible in case of a claim.

5. Additional Policy Inclusions: Determine if there are any additional inclusions that are relevant to your trip, such as adventure sports coverage, coverage for valuable electronics, or coverage for business equipment.

Conclusion

Comprehensive trip insurance is an essential investment when planning a trip. It provides extensive coverage to protect your travel investment against unexpected events that can cause financial loss. By choosing the right policy, you can enjoy peace of mind knowing that you are prepared for unforeseen circumstances. So, don’t wait! Safeguard your travel investment today with comprehensive trip insurance and embark on your journey worry-free!